Policy Update

Agrivoltaics in 2025: Nevada and Oklahoma Among States Combining Benefits of Farming and Solar Energy

July 10, 2025

Overview

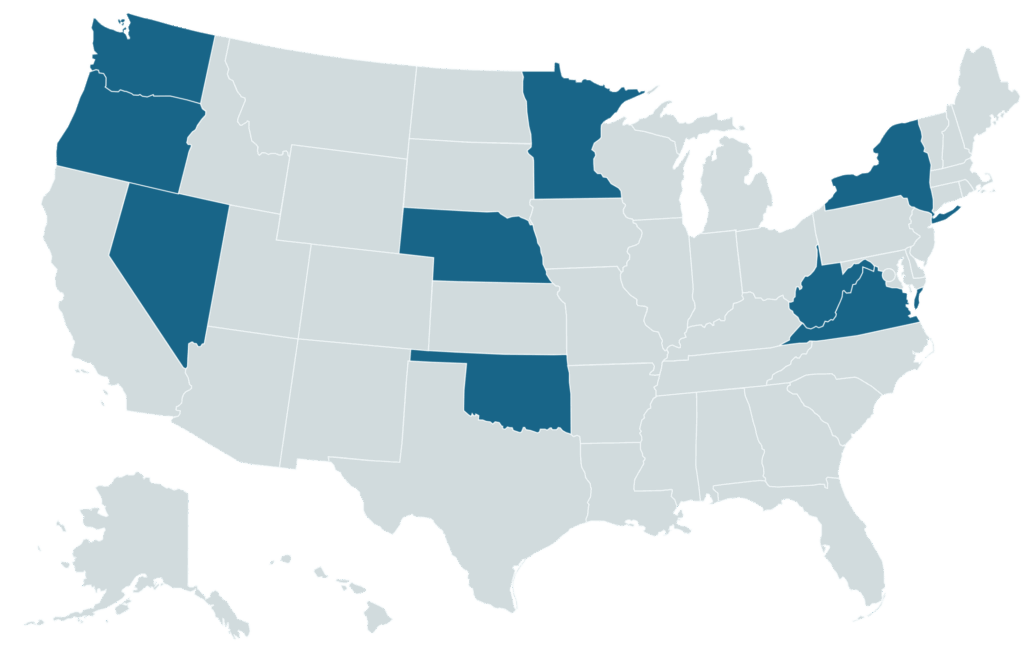

As states accelerate the shift to renewable energy, more lawmakers are embracing policy solutions that support the dual use of solar power and farming on the same land, known as “agrivoltaics.” In 2025 alone, at least 12 agrivoltaic bills were considered across nine states, with states like Nevada and Oklahoma leading the way with innovative policy models. Many state-level agrivoltaic bills have received bipartisan support, signaling growing interest and consensus on the issue.

Agrivoltaics: Farming and Clean Energy for a Sustainable Future

Agrivoltaics – co-locating solar panels on farmland – is a powerful way to expand renewable energy while supporting American farmers. With just 4% of U.S. electricity currently coming from solar, there’s major growth potential. Up to 40% of electricity could come from solar by 2035 with effective policy drivers and land-use planning.

- The Opportunity: Since farmland covers 43% of the lower 48 states and often offers ideal solar conditions (high sun exposure and flat land), agrivoltaic systems can create a win-win scenario to address multiple state priorities, including renewable energy generation, sustainable agriculture, economic growth, and climate resilience. For individual farmers, agrivoltaics can boost farm productivity and crop resilience while providing an additional source of income from energy production. By enabling energy production on farmland, agrivoltaics can also reduce pressure on undeveloped landscapes and lessen land-use competition.

The 2025 State of Play: Which States Advanced Agrivoltaic Bills?

Across the nine states that introduced agrivoltaic legislation in 2025, policy approaches ranged from pilot programs to tax incentives and integration with land management planning. Oklahoma and Nevada were among the states to advance noteworthy agrivoltaic legislation this year. Below, we take a closer look at the two innovative bills.

Oklahoma: A Comprehensive Plan to Advance Agrivoltaics

The Oklahoma legislature advanced the bipartisan Oklahoma Agrivoltaics Act (H.B.2157), but the two chambers were unable to agree on a final version of the bill before the session ended. The bill would have provided for research and funding to develop more agrivoltaic systems in the state by doing the following:

- Advisory Committee: The bill would have established a committee to identify opportunities, conduct outreach, and advance educational materials for the siting of renewable energy and transmission systems in a manner supportive of farming.

- Report: The committee would have been required, in consultation with the Oklahoma Center for the Advancement of Science and Technology (OCAST), to submit a report outlining (1) existing tools and initiatives to support agrivoltaics, (2) policy options to support agrivoltaic development, and (3) recommended areas of research to allow for agrivoltaics to have minimal impact on agricultural production and forestry.

- Funding: The “Oklahoma Agrivoltaics Cash Revolving Fund” would have been created for OCAST to carry out the provisions of the bill.

Nevada: Agrivoltaic Tax Benefits for Farmers

Nevada enacted bipartisan legislation (A.B.479) in June, which updates the state’s property tax code to support agrivoltaic land use. Here are the bill’s key components:

- Defining Agrivoltaics: First, the bill explicitly defines agrivoltaics as a system “under which solar energy production and agricultural use occur in an integrated manner,” conducive to farming activities.

- Establish Tax Benefit: Second, the bill establishes that land used for agrivoltaic purposes qualifies as an “agricultural use” and can receive the same property tax benefits as traditional agricultural land.

Other State Action: Co-Benefits and Tax Credits

In addition to Nevada and Oklahoma, several other states pursued innovative policies in 2025 to explore and expand agrivoltaics.

- New York introduced S.5628, which would have established an Agrivoltaic Production Tax Credit to incentivize farmers to integrate solar power generation with agricultural production.

- Minnesota advanced bipartisan legislation (H.F.2297 / S.F.2653) to establish a special license plate that would fund and expand the state’s Habitat Friendly Solar Program, which promotes pollinator habitats, soil health, and other co-benefits in solar energy projects.

Stay Informed on State Policy With NCEL

Stay up to date on trends in climate, sustainable agriculture, and energy policy across the country with NCEL’s Bill Tracking Map.